BigCommerce, a company behind SaaS ecommerce platform is going to IPO. In this blog post I’ll try to make a prediction, what will be company market capitalization. The time will show am I right or wrong soon.

BigCommerce finances

Let’s extract the most important number from BigCommerce SEC filing.

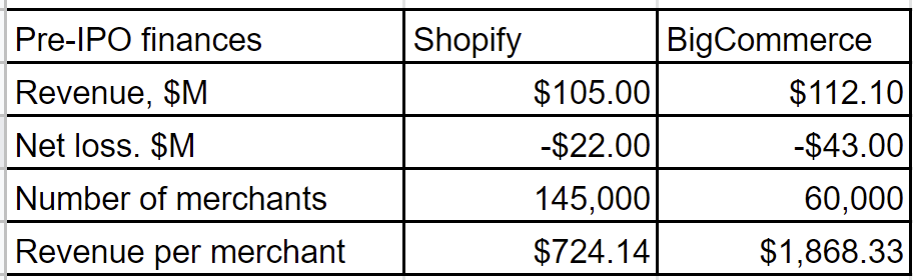

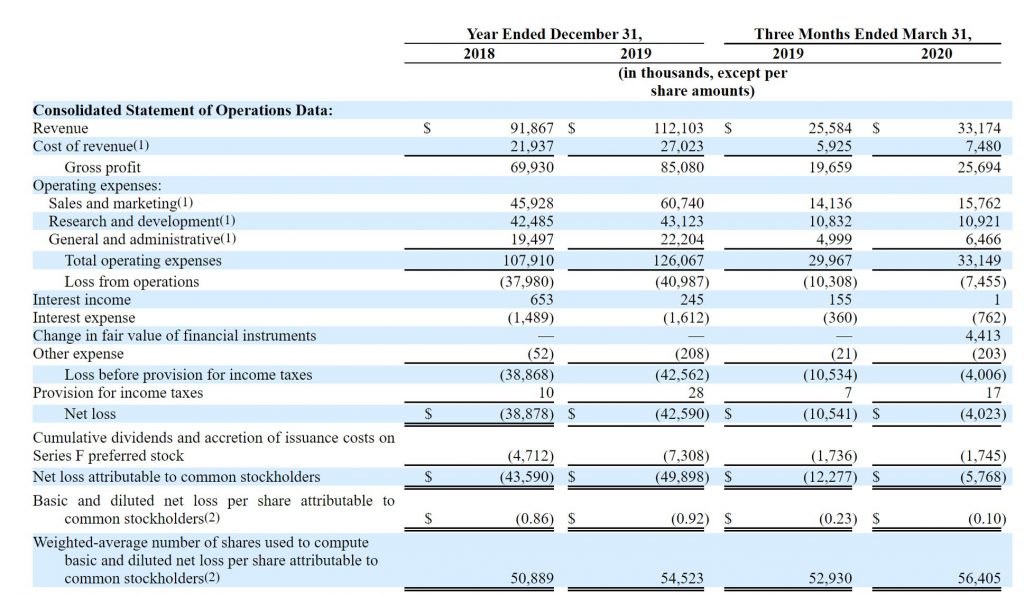

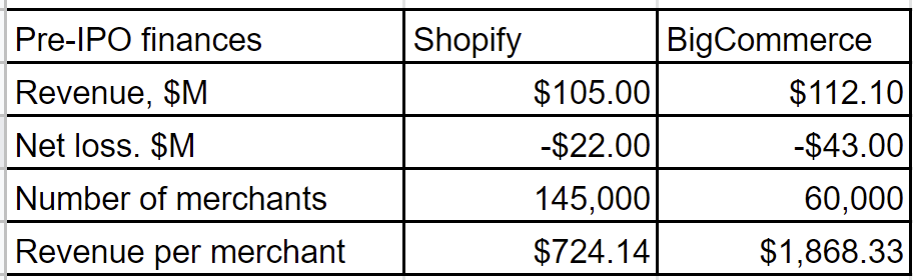

So for 2019 we have

- Revenue: $112.1M

- Gross profit: $85M

- Net losses: $$42.6M

We also know that company served around 60,000 online stores.

That data helps us to find out possible BigCommerce valuation

No profit, but sales

There are couple most popular methods to valuate a business: P/E (price to earning) and P/S (price to sale). Since BigCommerce isn’t profitable P/E is irrelevant, so we will use price to sale methods.

The question is what will be our point of comparison?

eCommerce darling – Shopify

Shopify (NYSE:SHOP) is stock market ecommerce darling and BigCommerce direct competitor. Now Shopify is one of the most higly valued (or overvalued) companies with a crazy P/S ratio of 65.

With such P/S ratio BigCommerce valuation will be whopping $7.3B. But this is very high end and unlikely – Shopify has much bigger market share (it claims to have 1,000,000 merchants), publicly traded company for almost five years with demonstrated higher than BigCommerce growth.

So $7.3B valuation is a very unlikely top end. For more correct comparison it is better to look at Shopify own IPO numbers. Thanks to still publicly available Shopify SEC filing we can check how the business looked that time

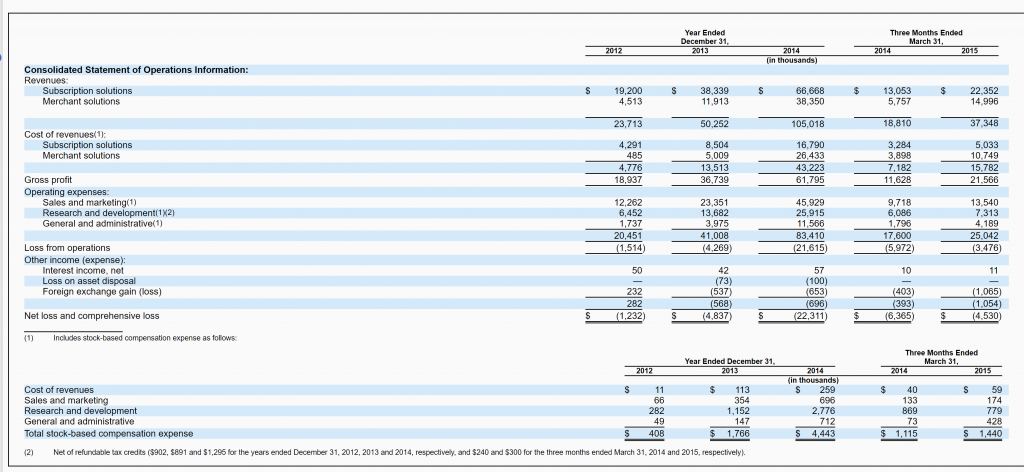

We may see that the last full year (2014) Shopify had:

- $105M revenue

- $61M gross profit

- $22.3M net loss

It had 145,000 merchants that time.

What is also important to note that Shopify had 2 main sources of revenue – merchant subscription fee and transaction fee (from processing merchant payments). BigCommerce doesn’t have payment processing business.

So Shopify had more merchants, but smaller ones and had less substantial net loss.

At IPO Shopify shares were sold for $17/share, the company was valued in $1.27B

That valuation makes Shopify P/S at IPO time equal to 12.

With such P/S BigCommerce valuation will be $1.3B

Wider tech IPOs

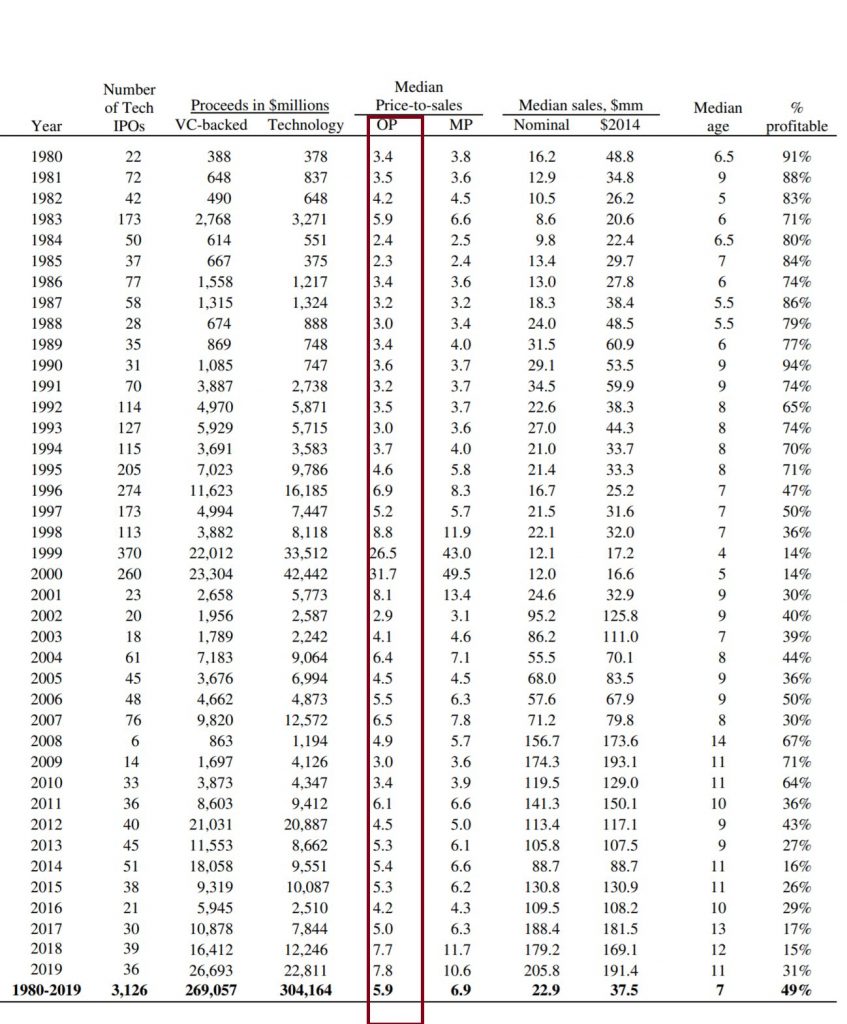

Historically it is quite high P/S for tech company, from 2000 to 2020 average P/S of tech IPO varied from 3.4 to 7.8

With more modest 7.8 P/S average for last year BigCommerce valuation will be $874M

BigCommerce case

So where BigCommerce is likely to end? We have quite wide corridor from $874M (last tech IPO average) to astronomic $7.3B current Shopify P/S

Up factors

- Current asset bubble. We experience a very strange time – economic downturn, but rocketing assets (including stock) prices. If the music continue to play at the time of BigCommerce IPO that pushes its stock price up

- Growing industry. Again related with this crisis the whole ecommerce industry got a boost. So it’s possible for market player not only divide the existing pie, but also grow it

- Limited moat. Shopify is definitely a leader, but the network effect is very limited and a new merchant doesn’t lose much (if anything) selecting BigCommerce over Shopify

Down factors

- Shopify had higher growth at IPO time than BigCommerce (over 2x comparing with 22%) at IPO time

- Even now Shopify with P/S of 65 is an outlier, very few companies have such ratio. Another company in similar business, Square has much more modest P/S of 10

- BigCommerce loses more money absolute and relative to revenue than Shopify at IPO time

Verdict

With all positive and negative factors taken into account my prediction that BigCommerce valuation will be near $1B

In few months we’ll see is it right or wrong

Disclosure: I have no positions in any stocks mentioned and do not plans to invest in the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. My ecommerce consultancy business Magenable is an official BigCommerce partner.

IPO happened.

While initial price was close to my $1B estimation (around $1.5B), shortly after IPO the share price skyrocketed.

So overall valuation jumped to over $5B.

Up factors played

Follow up. 1.5 years on, Bigcommerce market cap is a bit under $2B

2 years past IPO

BIGC capitalization is $0.6B (with TTM 0.271M), so P/S dropped to 2.2