This article has been originally posted in my LinkedIn.

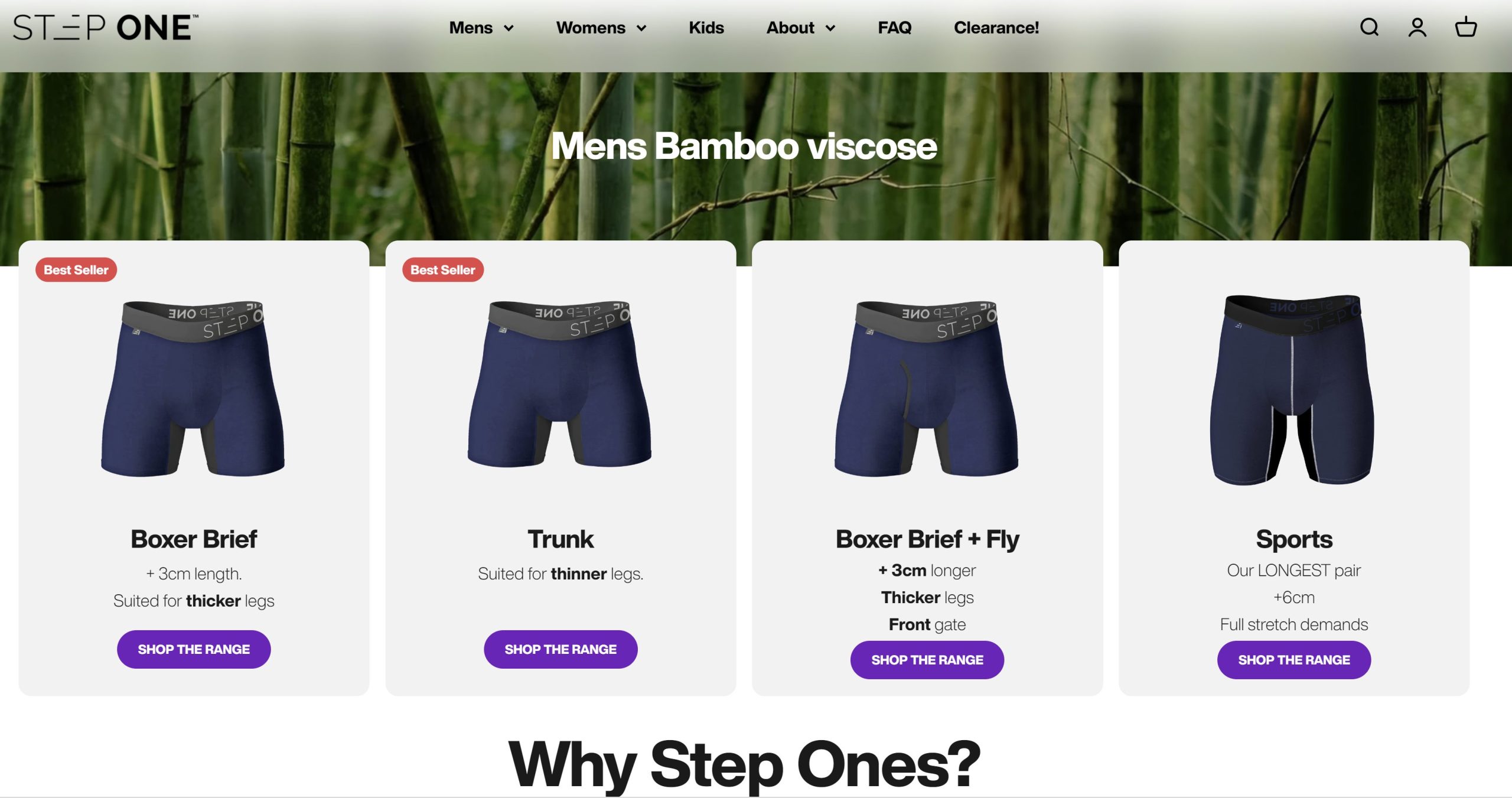

Recently thanks to Jason Andrew reference I had a chance to read through a half-year investor presentation of ASX listed Australian DTC business Step One. Step One is a DTC business selling bamboo underwear online in Australia, UK and US.

It is a good example of successful and profitable pure-play merchant, a dream that many ecommerce start-ups aspire to achieve. I highly recommend downloading and exploring the entire presentation(link provided at the end of this post).

In this post I present the most intriguing aspects from the report.

Very solid conversion. Despite a slight reduction from previous years, Step One boasts a remarkable 5% conversion rate, significantly surpassing the average 2% benchmark seen across the industry.

Returning Customer Loyalty: Step One demonstrates reasonably good Average Order Value (AOV) and a notable number of products per order. Two out of every three orders are from returning customers, indicating strong brand loyalty.

That is probably the most interesting pair of slides. The business has new customer acquisition cost of $87. It is almost equal to AOV ($91), almost whole first order revenue goes to Google and FB.

Step One boasts an impressive gross margin of over 80%. However, this seemingly enormous margin is swiftly consumed by advertising, marketing, and fulfillment costs, especially with the added perk of free shipping. As reported, the management this year has made a significant decision to prioritize profitability over relentless growth, starting with a reduction in advertising spending compared to previous periods. Thanks to this strategic move, the business is now turning a profit. However, this shift in focus has resulted in a temporary plateau in the brand’s growth trajectory.

It is stunning, how huge is Google/Meta tax even for established businesses with over 1M subscribers base. Let’s calculate how soon Step One makes their money back from newly acquired customer.

There were 375K orders overall. With 36% of new customer orders, number of such orders from new customers is 135K. With acquisition cost $87 per new customer it comes to $11,745K cost to get these new customers. The rest of orders, 240K are from returning customers.

Overall CAC (Customer Acquisition Cost) is $31.8 x 375K = $11,925K. It is less than just $200K difference with new customers acquisition budget. Probably that $200K were spent to acquire returning customers: something like cost of remarketing to cart abandonment. On the scale of things we may probably assume that getting returning customer back is almost free.

On returning customer the business is making 54% EBIDTA (20.8% overall EBIDTA+30.2% ad expenses not applied). With $87 average order it is $47.

With each customer’s first order, the business earns $18. When we combine this with the subsequent returning customer’s average order value of $47, we get a total of $65. However, even after the second order, the business has not yet recouped its customer acquisition cost (CAC). It is only after the third order, totaling $18 + $47 + $47 = $112, that Step One finally starts earning $21 in profit for itself.

If a customer dropped before third order – Step One loses money paid to Google/Meta and other ad vendors.

Important to note that Step One product has quite high potential for repeat purchase (subject of product being good). If your products have lower repeat purchase potential – the game is even more tough for your DTC business.

The question is how far Step One can stretch their loyal base, where are the limits? According to researches, average man has 10 to 15 pieces of underwear in his wardrobe. Let’s take an average 12. With average order number of 4 pieces it means that after 3rd order an average customer replaces all his stack of underwear and becomes less likely to purchase more. Since Step One is positioned as a premium brand (with a product price of $30+ normally), their customers likely have expectations that the boxers they purchase for such premium price last for a while, at least several years. If they not – many will be disappointed and not buy again.

That makes Step One task very ambitious – they must push their customers to the limit of the share of wardrobe to be profitable. So virtually all underwear for an average customer should be from Step One. We’ll see in the next reporting periods how they managed to achieve this.

The bottom line from this report is that DTC ecommerce is a tough game, even for a big, successful business with very healthy gross margin.