Recently ATO published data about the biggest businesses in Australia and how much do they contribute to the budget. According ABC report, around 1 of 3 of this large local and multinational businesses with at least one hundred million dollars of revenue paid zero income tax for 2014-2015 financial year.

As a little exercise I made my own version of interactive table with filters and sorters containing full data set. You may find it here.

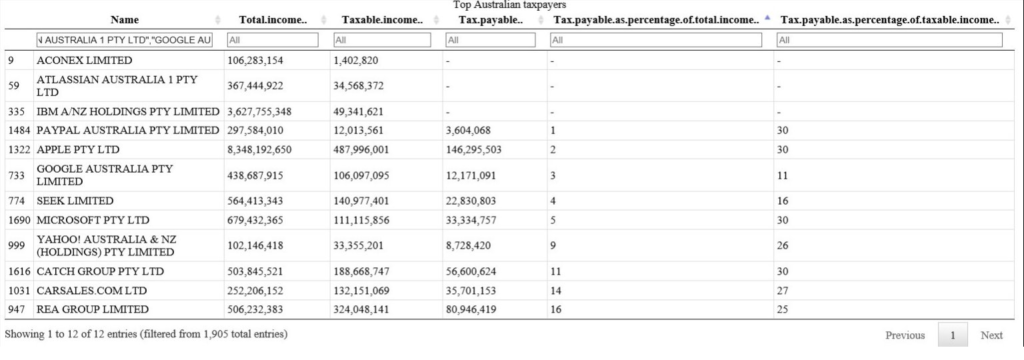

Out of curiosity I decided to see, how Australian IT/digital companies doing. What I’ve found is in the table below.

As you see the amount and share of taxes paid are very different – from 16% of income for REA Group to nil for Aconex, Atlassian and IBM.

The chart below shows this in more visual way.

As ATO notes “no tax paid does not necessarily mean tax avoidance”, as “the aggregate figures listed cannot and do not reflect the complexity of the tax system”, but the difference between how different businesses pay their share of income tax is startling. When I checked the data, I immediately recalled an article of Mark Ritson “Should marketers really aspire to be like Google and Apple?”

BTW, appeared that Google and Apple are not the worst in terms of income/tax paid ratio, they at least pay some taxes.

You may play with the interactive table and find out how other businesses pay taxes, lot of interesting findings to be discovered.

References

- “Who pays what? ATO names large companies that paid zero tax in 2014-15”, ABC – http://www.abc.net.au/news/2016-12-09/tax-data-transparency-ato/8106178

- Mark Ritson: Should marketers really aspire to be like Google and Apple?, Marketing Week – https://www.marketingweek.com/2016/02/03/mark-ritson-should-marketers-really-aspire-to-be-like-google-and-apple/