How the bigges tech companies paid their share of taxes in Australia, 2016-2017 data

ATO has published a fresh data about the biggest taxpayers, so I decided to revisit how the biggest and apparently the best Aussie and global technology businesses with Australian presence paid their taxes. I wrote a similar blog post 2 years ago with 2014-2015 data used, so was very curios to see the changes.

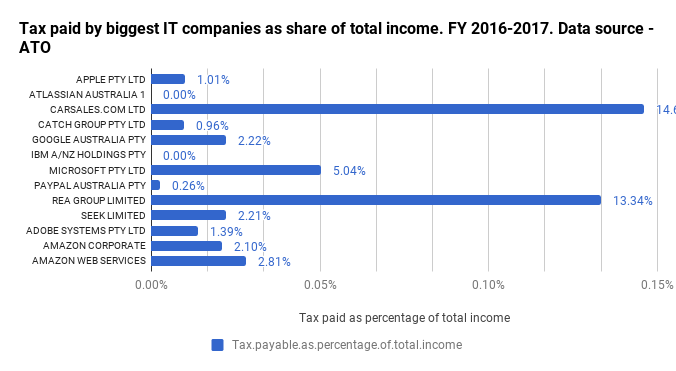

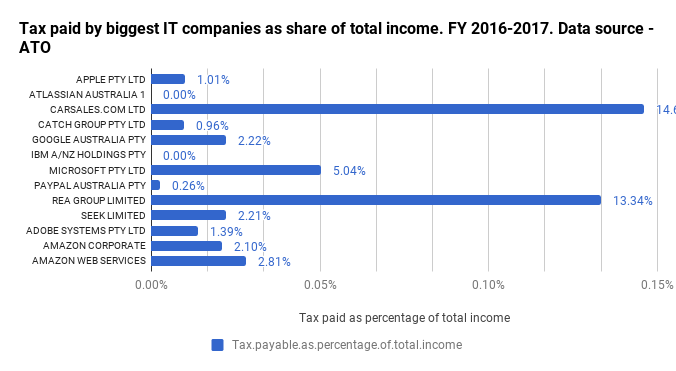

Here is what I’ve found in a table form:

| Name | Total Income.. | Taxable Income | Tax payable | Tax.payable.as.percentage.of.total.income | Tax.payable.as.percentage.of.taxable.income |

| APPLE PTY LTD | 8,065,292,361 | 271,485,613 | 81,384,222 | 1.01% | 29.98% |

| ATLASSIAN AUSTRALIA 1 PTY LTD | 773,974,561 | 117,061,272 | 0 | 0.00% | 0.00% |

| CARSALES.COM LTD | 292,788,881 | 159,317,300 | 42,789,796 | 14.61% | 26.86% |

| CATCH GROUP PTY LTD | 308,004,407 | 9,850,769 | 2,955,231 | 0.96% | 30.00% |

| GOOGLE AUSTRALIA PTY LIMITED | 1,490,271,916 | 177,565,887 | 33,105,352 | 2.22% | 18.64% |

| IBM A/NZ HOLDINGS PTY LIMITED | 3,308,833,672 | 17,671,522 | 0 | 0.00% | 0.00% |

| MICROSOFT PTY LTD | 1,062,120,533 | 178,419,545 | 53,525,864 | 5.04% | 30.00% |

| PAYPAL AUSTRALIA PTY LIMITED | 419,098,887 | 3,674,699 | 1,102,410 | 0.26% | 30.00% |

| REA GROUP LIMITED | 789,291,016 | 386,177,423 | 105,285,113 | 13.34% | 27.26% |

| SEEK LIMITED | 595,064,481 | 130,285,542 | 13,147,581 | 2.21% | 10.09% |

| ADOBE SYSTEMS PTY LTD | 314,904,818 | 14,635,783 | 4,390,735 | 1.39% | 30.00% |

| AMAZON CORPORATE SERVICES PTY LTD | 329,854,739 | 23,049,822 | 6,914,947 | 2.10% | 30.00% |

| AMAZON WEB SERVICES AUSTRALIA PTY LTD | 124,697,769 | 11,693,261 | 3,507,978 | 2.81% | 30.00% |

The last 2 columns is tax paid as a percentage of total and taxable income.

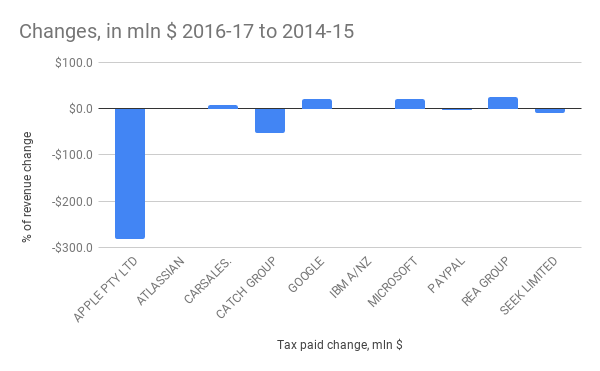

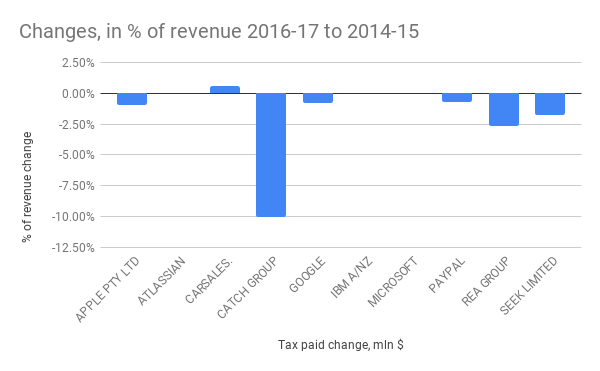

Here is also a comparison of the data from 2014-2015 and 2016-2017 financial year

So what we see:

- As it used to be in the past, couple companies (IBM and Atlassian) don’t pay any income tax at all in both periods in spite of having taxable income

- Most of those who paid, contributed less than in 2014-2015 in terms of percentage of revenue. Only Microsoft and Carsales have this metric increased

- Apple has the biggest drop in absolute amount paid, minus $82M and not the biggest taxpayer in the group anymore

- The biggest taxpayer now is REA Group, that paid over $105M

Paying taxes and corporate social responsibility

There were interesting discussions in social media after ATO released this data, for example here is Tweet from Mark Ritson that sparked number of replies

So out of I’ve decided to check what two companies who constantly not paying income tax write about CSR

Atlassian

A big success story of Aussie tech business, some great products.

On the company website I have found the next information

- 1% donated of all profit, employee time, and equity

- $100 million donated in Community licenses

Is it good enough to compensate not paying income tax in home country?

I am not sure, but you may have a different opinion.

IBM

IBM has a whole website section about Corporate responsibility. It features the next quote from IBM Australia Managing Director:

IBM is not defined by what we make, but by the difference we make in the world. Our innovation isn’t only technical – IBM was one of the first companies in the world to have Environmental Policies, Diversity Policies & Recycling Policies. We understand that responsible and ethical conduct is the best way to grow as an organisation, as a community, and as Australians.

Kerry Purcell, Managing Director IBM Australia and New Zealand

It also publishes reports, the last one I see is for 2013 though.

On Yahoo! Finance we may notice that for year 2017 (it is a bit different in US, but anyway), there was $5.8B of Net Income From Continuing Ops reported.

And zero income tax paid in Australia both in 2014-15 and 2016-17 FY.